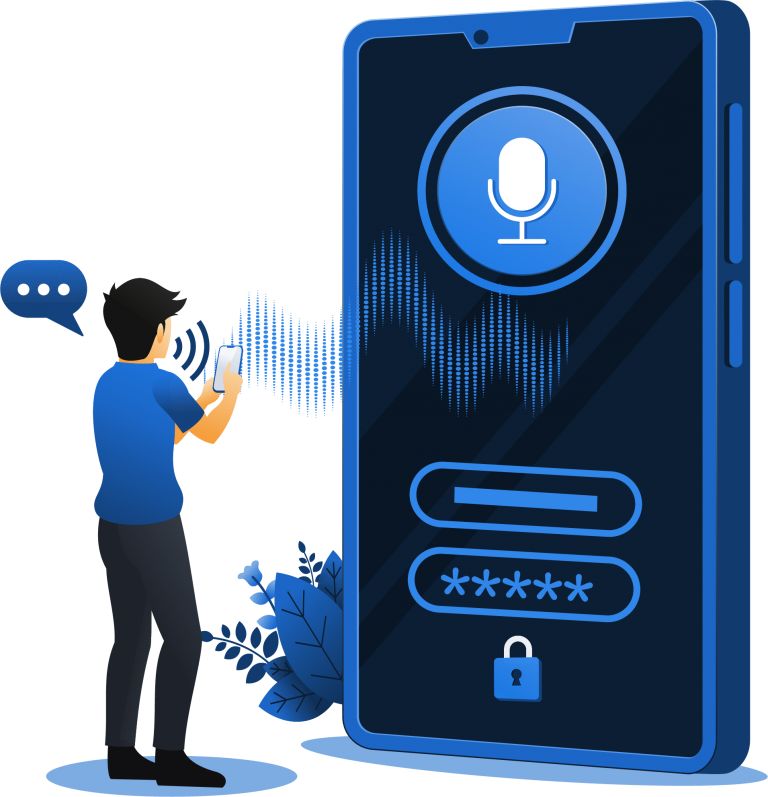

While voice authentication today is going to be a hot topic, by no means it is a new concept. Traditionally, voice authentication was meant purely as a way of replacing a user’s password. It was a very manual process to establish your voice password today we’d refer to that as “active enrollment” and was limited to very specific ways of using it (typically challenge-response model).

While active enrollment still makes sense for many companies, one big improvement in voice authentication that has occurred relatively recently is the idea of passive enrollment. This means that the system would be listening to the conversation and using multiple forms of authentication to prove identity and automatically collect a voiceprint that can then be used later, also in real-time. This can be done in as few as 3-4 seconds with no acknowledgment by the end user, and unlike a voice password, it’s not a recording of the voice that is employed in authentication or comparison to other voices. Instead, it is the characteristics of the voice recorded.

Enhancing Security and Efficiency with Voice biometrics

Voice biometrics has several benefits. There is no information to lose. More importantly, this produces a much more flexible, accurate, and quicker identification later on. This enables contemporary voice biometrics to correctly identify you even if you have a cold, just woke up, haven’t had your coffee, or just sound a little different today. And all without having to use the very words used during the original enrollment!

But, again, apart from the obvious “real-time authentication” concept, what else does voice biometrics have to say? There is one specific application of voice biometrics that I think phenomenal is real-time fraud prevention. This is the idea that once we discover someone who is committing fraud, they ought to be placed on a “list of suspected bad actors” so that the next time that individual, reaches out to your business, will be recognized as an individual who has a history of fraudulent activities. The system could flag the call to inform the agent that the caller is on the fraud watchlist and could be a suspected bad actor. This can be further escalated internally to the fraud analysts to take appropriate actions to prevent fraud.

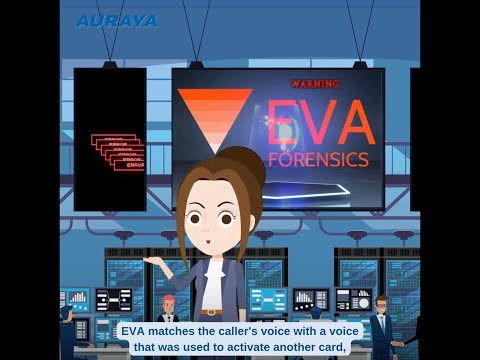

Unleashing the Power of Auraya’s EVA Forensics for Successful Detection of Fraud in the Banking and Finance Industry

Financial institutions house a large number of sensitive information that draws fraudsters and hackers towards this sector. Financial fraud and breaches of information are more common today. Thus, having robust security measures became obligatory for financial institutions to protect their clients and assets. Voice biometrics is becoming one of the most powerful tools in preventing fraud and data breaches.

Auraya’s EVA Forensics is an innovative voice biometrics technology that would give financial institutions a sound, secure, and efficient solution by immediately detecting fraud in real-time conversations with agents and IVR.

EVA can also identify fraudsters by sending an alarm if it identifies any unusual or suspicious activities. It will thus prevent fraudsters from gaining any access to a customer’s data, this helps to prevent them from accomplishing unauthorized transactions.

EVA Forensics helps in proactive fraud detection and prevention, and this is likely to protect the financial institution from losses and save its clients financially.

It is set up to meet the robust security and compliance requirements of the financial sector, and the technology is compliant with all data protection regulations while observing the privacy of the user.

Fraud Detection and Prevention

Integrating EVA Forensics to existing consoles, organizations can track and manage voiceprints and create any list of known fraudsters versus suspicious fraudsters. EVA Forensics will help reduce any possibility of fraudulent attempts and will deter fraudsters.

Flagging suspicious calls in real time gives an organization the ability to take necessary steps to prevent fraud from being perpetrated against its customers.

Secure your Contact Centers with Voice Biometrics

Today, contact centers are evolving to be more agile and mobile. Working from home or outside the office often exposes one’s business and organizations to more threats, and thus more probable risks of security attacks. Keep your customers, your employees, and your organizations safe from fraudsters before it is too late. Protect your organization with voice biometrics.

Integrate Auraya’s EVA Voice Biometrics suite of capabilities into your organization’s existing contact center solutions today.

Want to learn more about Auraya’s voice biometric AI technology? Reach out to us today at info@aurayasystems.com!