On October 30, Japan’s largest financial media organization Nikkei released a press statement announcing that they were the recent victims of fraud. The incident happened in late September 2019 where an employee of their US subsidiary at Nikkei America, Inc. was fooled into transferring approximately $29 million of Nikkei America’s funds.

The fraudster succeeded through a business email compromise (BEC) scam where he sent a phishing email posing as a Nikkei America management executive. According to David Barnhardt, Chief Experience at GIACT, the fraudster took it one step further by physically emulating the sound of his voice over the phone to match the management executive victim.

This incident highlights the fact that strong security is necessary for any type of financial transaction, whether it is a small or large transaction. The identification and verification of the people involved should be implemented for every step of the process – from emails and calls to web interactions.

Hence, companies should invest in the next-generation voice biometric technologies such as Auraya’s EVA capability. EVA can be deployed in both telephony (legacy or cloud-based like Amazon Connect) and digital channels. This means organizations can seamlessly implement voice biometrics into their existing solutions. Whether it’s a contact center IVR, browser transactions, customer support chatbots or their mobile applications, organizations can easily verify an identity in any stage of the transaction, from opening a new account to confirming a transaction.

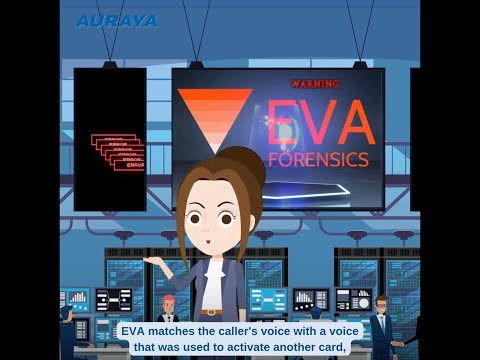

With EVA, organizations can detect fraudulent attempts via fake voices whether it is physically mimicked, generated, modified voice or even recorded. Using machine learning algorithms, synthetic voices are easily detected and rejected and listed on an impostor map. Once detected, organizations can build a database of fraudulent or synthetic voices through impostor mapping, allowing organizations to detect past and future fraudsters in real-time.

If next-gen voice biometrics technology such as Auraya ‘s EVA capability was implemented into Nikkei’s existing customer and employee-facing solutions, the fraudster would have been proactively detected and caught before any financial transactions were finalized.