The Australian Government’s Office of the Australian Information Commissioner (OAIC) recently published their Notifiable Data Breaches Report for January to June 2020. The report details periodical statistical information about the notifications or complaints received under the Notifiable Data Breach scheme to keep everyone up to date on the state and severity of data breaches.

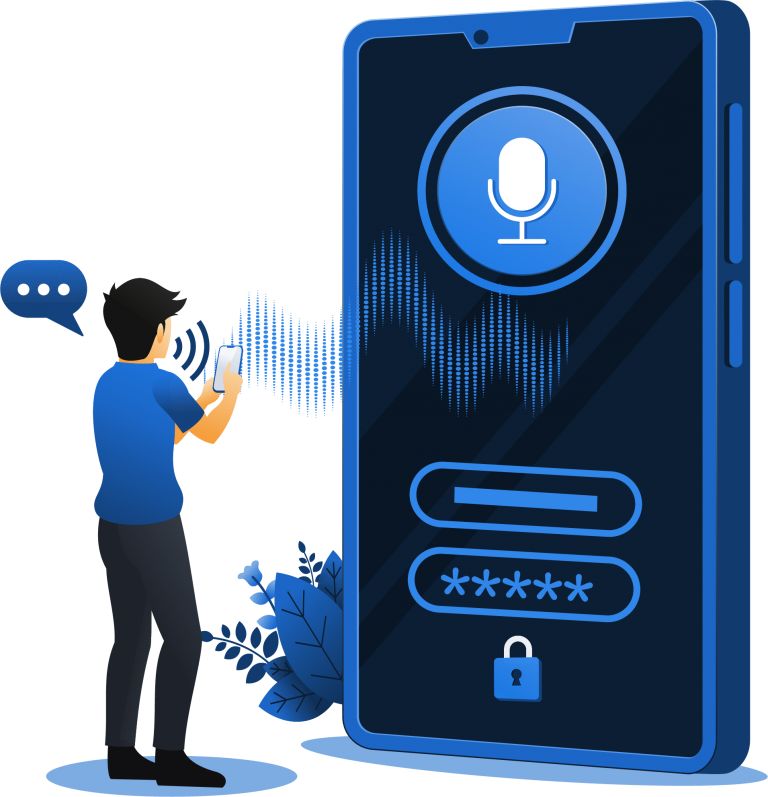

The report finds that ‘malicious or criminal attacks’, which includes cyberattacks, remains as the top cause of data breaches, making up 61% of all notifications or complaints. Interestingly, human-related errors accounted for 34% of all the data breaches reported. Organizations can reduce the risk of human-related errors by implementing better and more stringent security measures, both internally and externally. One way organizations can achieve this is by using voice biometrics as part of their identity and access management policies. With Auraya’s voice biometric technology, organizations can identify and verify customers and staff seamlessly and securely without having to waste time conducting manual verifications such as asking for PINs and security questions. For example, customers calling into an organization’s call center can be verified during the IVR prior to speaking with an agent so that the agents can more quickly assist the customers, saving time and money. Auraya’s voice biometric technology can also be used as an additional factor of authentication when conducting high-risk transactions. The customer’s voice can also be used to verify their identity as well as authorize transactions in digital channels. The voice biometric confirmation provides a secure, unique digital signature to confirm the transaction electronically.

The report also highlights the health sector (22% of data breaches) and the finance sector (14% of data breaches) to be the most common targets of a data breach. This comes as both sectors hold a lot of personal customer information, which is highly sought after by fraudsters. With personal information such as a person’s name, date of birth, address, email, telephone number and even credit card numbers, fraudsters can easily conduct various types of fraudulent activity such as credit card fraud, loan fraud and account takeovers. Organizations using outdated security measures such as asking for personal information and security answers are easy targets once the fraudsters obtain the necessary stolen information. However, with voice biometrics, organizations can replace asking customers with security questions, which involves stating personal information, as the customer’s identity will be verified automatically in the IVR, or in any other digital platform, before even connecting with the agent. This also gives the customers the comfort of not having to say their personal information to random agents, especially if the customer is in a place where they do not feel comfortable speaking such information publicly.

There are many more voice biometric use cases that organizations can use to improve their cybersecurity and protect their customers. Having voice biometrics as part of the organization’s security protocols provides them a better chance of detecting and deflecting potential fraudulent attacks such as a data breach. The cost of implementing Auraya’s voice biometric technology for better security and customer experience is small compared to the cost of recovering from a data breach.