1. Introduction Voice Biometrics in Banking

What is Voice Biometrics?

Voice biometrics is a speaker verification technology that captures a voice sample from a live speaker and compares it to a previously stored voiceprint. If the sample and the stored voiceprint are a match, then the speaker’s identity can be verified. Which represents the unique acoustic “signatures” in the voice associated with the speaker’s vocal tract and other anatomical characters, habitual speaking style including such things as accents and language, and cadence and pitch. Independent studies have proven that just as a fingerprint is unique to an individual, so is the voiceprint.

Importance of Fraud Prevention in Banking

Fraud in banking is a serious concern that can lead to significant financial losses for consumers and financial institutions. With increasing digital transactions, protecting sensitive information has never been more crucial. Each year, banks invest a lot of resources into preventing fraud, as the consequences of an incident can be costly in terms of both money and reputation.

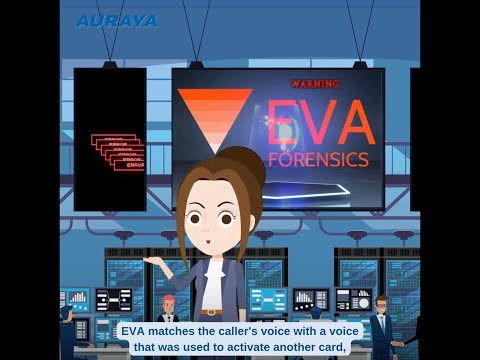

How Auraya Voice Biometrics Works?

The demand for better cybersecurity measures increases yearly as fraudsters attempt more sophisticated attacks. This puts immense pressure on cybersecurity leaders to ensure the best security protocols and safeguard their organization and customers. With Auraya’s voice biometric technology and its patented machine learning algorithms, organizations can enhance security whilst providing a seamless and delightful user experience.

2. The Rising Threat of Banking Fraud

Types of Fraud Targeting Banks

Fraud in the banking sector can occur in numerous ways, including identity theft, account takeovers, and phishing scams. These Methods is designed to manipulate systems or trick individuals into revealing sensitive information.

The Impact of Financial Fraud on Consumers and Institutions

The fallout from financial fraud can be devastating. For consumers, it may lead to loss of funds, hit to credit scores, and emotional distress. For institutions, the damage might include legal issues, loss of customer trust, and financial penalties.

Traditional Fraud Prevention Methods and Their Limitations

Traditional security measures like passwords and security questions often fall short. Many people use easy-to-remember combinations or are prone to forgetting them, making them vulnerable to social engineering tactics or breaches.

3. Implementing Voice Biometrics Technology

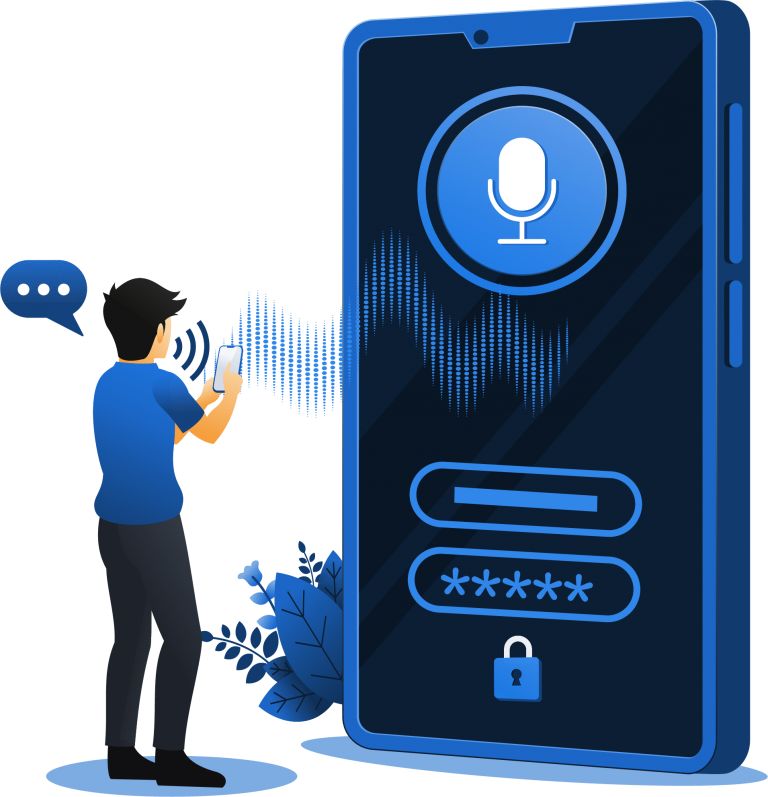

The Process of Voice Enrollment

To get started, customers typically undergo a voice enrollment process where they repeat specific phrases. This helps the system learn their voice’s attributes. It’s a simple and quick procedure, often completed in just a few minutes.

Real-Time Voice Recognition Techniques

Once enrolled, the system uses real-time voice recognition. This technique ensures that the verification happens instantaneously, allowing customers to access their accounts without frustration. The process is seamless yet incredibly secure.

Integration with Existing Banking Systems

Banks can tailor this technology to integrate into their existing systems, ensuring a smooth transition. This adaptability means that financial institutions can enhance security without needing a complete overhaul of their existing infrastructure.

4. Benefits of Voice Biometrics in Fraud Prevention with Auraya

Enhanced Security Features

Voice biometrics offers heightened security because it’s incredibly hard to replicate someone’s voice. Even if a fraudster gains access to a customer’s account details, tricking a voice recognition system is another matter entirely. Protecting against call fraud with secure devices and providing a reusable OTP using voice biometrics to establish the right customer is solidified by verifying an authentic user’s true identity. Auraya’s patented algorithm AI and random phrase challenges protect better against fraud by detecting both imitations as well synthetic voices than any other technology.

Improved Customer Experience

Customers enjoy the convenience of using their voice rather than typing passwords or answering security questions. This advancement not only speeds up transactions but also reduces frustration, leading to a more pleasant banking experience. With Auraya voice biometric technology no personal data (e.g. phone number, address, or a Social Security Number) is exchanged for each interaction made by the customer Verification is performed entirely through their voice, to enable secure transactions and interactions without revealing private data. Voiceprint data can be stored in an organization’s private systems, with the option to remain compliant and controlled by enabling home territory processing.

5. Challenges and Considerations

Privacy Concerns and Data Protection

Auraya voice biometric technology ensures that customers do not have to provide personal information with each interaction. Using this technology, customers will only have to say something to be confirmed. Voice can serve as a signal in the Identity and verification process, validating the customers’ identity, and allowing an organization to execute their customers’ requests while ensuring they are conversing with the actual account holder without that customer having to share any information with staff whether talking to contact center agents, during chat sessions, in applications or anytime they are doing any online transaction.

Increased Agent Efficiency

In a contact center environment, voice biometrics can replace inefficient and legacy verification methods. When a customer dials into the contact center, they get verified in the IVR before getting to an agent and hence, can be offered personalized self-service options. This limits the number of calls that require hands-on agent attention and also increases operational efficiency by significantly reducing Agent handling time.

6. Conclusion and Future of Voice Biometrics in Banking

Enhanced Security: Voice biometrics offers a secure method of verifying identity, significantly reducing the risk of fraud in the banking sector.

Unique Identification: Each person’s voice is distinctive, making it a reliable form of biometric authentication that is difficult to duplicate or forge.

Customer Experience: By enabling quick and seamless identity verification, voice biometrics improves the overall customer experience, reducing the need for complex passwords and lengthy security questions.

Fraud Prevention: The implementation of voice biometrics helps banks prevent unauthorized access and fraudulent transactions, thereby protecting customer accounts and sensitive information.

Cost-Effective: Over Time, The technology can prove to be cost-effective by reducing the resources spent on handling fraud-related incidents and enhancing the efficiency of customer service operations.

Regulatory Compliance: Implementing voice biometrics can help banks meet regulatory requirements for customer verification and data protection.

To learn more, visit www.aurayasystems.com, or email us at info@aurayasystems.com!