Banks are among the most frequent targets of fraud attempts. Criminals use stolen data, social engineering, and advanced digital tools to break into accounts and steal money. As fraud tactics grow more sophisticated, traditional methods of security are no longer enough to protect customers. This blog covers how banks use Auraya’s voice tech to keep accounts secure.

Even one-time passcodes sent via SMS are vulnerable to interception. To stay ahead, banks need security measures that are both stronger and easier for customers to use. EVA, powered by Auraya’s world-leading biometrics, is emerging as a powerful solution that makes banking more secure while keeping the customer experience simple.

Table of Contents

Why Banks Need Stronger Security

Every year, financial institutions lose billions of dollars to fraud. Attackers are constantly inventing new ways to trick customers and bypass security. Common threats include:

- Account takeover fraud – Criminals use stolen credentials to log in as genuine customers.

- Social engineering scams – Fraudsters impersonate bank representatives to convince people to hand over information.

- Phishing and smishing attacks – Fake emails and text messages direct customers to fraudulent sites.

The challenge for banks is to add stronger layers of security without creating friction for customers. Complex logins or repeated verification steps frustrate users, leading to poor experiences. A solution is needed that balances security and convenience.

What is Voice Biometric Identity Verification?

Voice biometric identity verification is a technology that uses the unique features of a person’s voice to confirm their identity. Everyone has a distinct voiceprint, shaped by physical and behavioral characteristics such as pitch, rhythm, and tone.

When customers speak naturally, Auraya’s system analyzes these characteristics in real time to verify identity. The process is quick, seamless, and requires no memorized details.

Key benefits include:

- Accuracy – Voiceprints are extremely difficult to copy or forge.

- Ease of use – Customers only need to speak naturally, without extra steps.

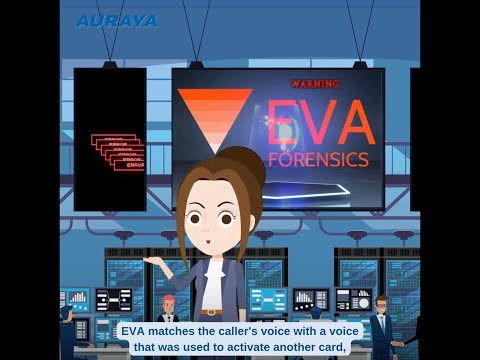

- Fraud detection – Auraya’s advanced systems can identify synthetic voices, recordings, and replay attacks.

How Banks Use Auraya’s Voice Tech in Everyday Security

Auraya’s voice biometric technology is already being adopted by banks to secure a wide range of customer interactions.

- Logging into Banking Apps

Instead of typing, customers can access accounts simply by speaking. The system verifies the voice instantly, making login faster and safer. - Authenticating Calls to Contact Centers

Phone banking is one of the most common targets for fraud. With voice authentication, customers can be verified within seconds of speaking, preventing impersonators from gaining access to sensitive accounts. - Securing High-Value Transactions

Banks often require additional checks for large transfers or changes to account details. Voice biometrics provides a simple but strong second layer of verification before approvals. - Protecting Digital Banking Services

From online platforms to mobile apps, voice authentication can be integrated across channels to ensure consistent security and reduce reliance on outdated security questions.

Why Customers Trust Voice Biometrics

For customers, security is important, but convenience is just as critical. People want to know their money is safe, but they also want fast and easy access to their accounts. Voice biometrics delivers both.

- Less frustration – Customers avoid long security processes and repeated questions.

- Confidence – Knowing their own voice is the key to their account building trust.

- Future readiness – As threats like deepfake voices emerge, Auraya’s technology adapts to keep authentication secure.

When customers feel safe and supported, they are more likely to stay loyal to their bank and adopt new digital services.

Conclusion

Fraud in the banking sector is growing more sophisticated, and traditional security methods are no longer enough on their own. To truly protect accounts while keeping customer experience smooth, banks need smarter solutions.

Auraya’s voice biometric technology provides that solution. By recognizing the unique traits of each customer’s voice, banks can stop fraud attempts in real time, secure transactions, and build trust across every interaction.

For customers, it means peace of mind and effortless access. For banks, it means reduced fraud losses, stronger compliance, and better relationships with the people they serve.

With voice biometrics, banks can stay one step ahead of fraudsters and keep accounts secure in a fast-changing digital world.